June 20, 2018

Every client has asked me this – Can i claim expenses incurred on my Car against my income? Can I reduce my taxes by doing so? What do I need to do to claim Car/Vehicle Expenses? Well I am going to answer all these questions and more in this blog

I would like to summarize the whole Vehicle Expense answer into this statement :

You can write off your vehicle expenses if used the vehicle for business and if you did, you need to keep track of all vehicle expenses and also keep the relevant receipts.

What Can I deduct in Car expenses ?

- Gas and oil

- Repairs and maintenance

- Insurance

- Lease costs or depreciation

- License fees

What is Business Use ? Travelling from office to a client is considered business and vice versa. You can only write off the proportion of expenses used for business purposes. Personal travel is not deductible. To do this, you should keep a kilometer log of your business use.

Can I deduct travel from home to office and vice versa ? Travel from your home to the office is personal and the km’s can’t be counted, similarly, travel from the office to home is also personal. Tip : However, if you drive from home, to a client and then to the office (or vice versa – from the office to a client to home) then the entire trip is considered business.

What do I need to do, to deduct Vehicle Expenses ? To justify your vehicle expenses, you should maintain as accurate a vehicle log as you can – Kilometer Log. The log should detail the date of the trip, the place you are travelling to, the person you are meeting with and the number of kilometers driven between Key points.

What if I don’t keep a Kilometer log? Then in that case, your actual business use will be scrutinized by an auditor who will more than likely challenge the percentage you have chosen. Tip : In some cases, CRA has allowed taxpayers to go back and formulate a log (i.e. based on appointments, events, etc.). In other cases some have allowed a test month where a detailed log is kept for a period of time and the period under audit is assessed using that amount.

What records should I maintain to deduct Vehicle Expenses? –

- Kilometer log : As mentioned, a kilometer log should be maintained to justify your kilometers

- Receipts & Bills : For a proprietor/partner, you must keep all of your gas receipts, repairs and maintenance invoices, insurance policies, etc.

- Proof of Payment : You should also have some sort of “proof of payment” such as Credit Card statements or your bank statement (for debit transactions).

Note: Its not a good idea to pay cash for gas. (we’ve had auditors state “Anyone can get their hands on a gas receipt and use it as their own”). With the receipt and a statement, you will have no problems. Typically, we ask clients to use one credit card for all of their business expenses including their vehicle expenses. Make vehicle mileage a part of your monthly expense reports (more to follow on expense reports). Your kilometer log should make sense when compared to your gas receipts and maintenance logs (don’t get carried away by over-claiming the mileage. An audit can easily reveal the true vehicle mileage).

What if I have 2 vehicles that I use for business? You would basically have to do 2 vehicle expense worksheets for the 2 vehicles and do the best you can to allocate the expense among them.Another option is to take the total expenses of both vehicles and then take the total business km’s driven on both cars as a proportion to the total km’s driven on both cars.

Do I have to keep Kilometer log if a vehicle is used 100% for business? You could claim the 100% business use but you still need the log to prove it. In that case all the km on the log would be business so the log would have to prove that.

Can Winter Tires be deducted as an expense? Yes, you could claim the winter tires under Repairs & Maintenance expense.

What if I have leased a vehicle, how much expense can i claim? For leased vehicles, you would be able to claim the lease costs (up to the allowable limit) $800+HST/GST per month.

What if I have purchased/financed a vehicle, how much expense can i claim? If you have purchased a vehicle for e.g. worth $30,000 for cash, you would claim CCA on the business portion of the vehicle. If the vehicle is financed, in addition to CCA you could also write-off the business portion of the interest expense. The vehicle would either be classified as a Class 10 or 10.1 vehicle depending on what kind of vehicle it is and then depreciated at a rate of 30% per year (with the 1/2 year rule applying in the first year).

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

June 11, 2018

CRA using Social Media to its Advantage?

Well over the last few months we have come across this – a lot – CRA could be using social media to determine if people are reporting their income correctly or not and they could be using it as a tool during their audit process.

So the way this came to light was a few months back, CRA started targeting people from LinkedIn, who were bragging about their return on investment from their TFSA investments. There were people on LinkedIn that were stating that they were making $ 100K or more and it basically triggered the CRA to look at these people and see whether or not they were following the rules that they needed to in relation to TFSA accounts and that’s how it all started.

Now in my own personal experience I was actually discussing this with my colleague and she told me about this case where her client was audited because of Social Media.

Excerpts of the Case:

So one of the client of my colleague was audited and he has a sole proprietorship, which was pretty successful so as a part of the audit the client was requested to provide all the previous months bank statements for everybody in the household which also included the spouse of this person.

Now the CRA Auditor visited his office and found out on his work computer there were several social media websites related to salon service, on further investigation it was found out the that his spouse was actually running a side business of a salon/massage in the basement of their house, which is no problem but when the auditor actually went and looked at her personal tax return there were no statement of business activities and there were no gst/hst numbers or corporate account numbers registered under her name either.

So there was a clear case that there is no reported income and obviously because it was the massage/salon industry and everything was on cash, hence there was nothing in the bank account therefore she thought she was free and clear, well in this case she was caught by social media, believe it or not!

Obviously there’s a whole avenue of things involved and it could be a little bit of a horror story at the end of the day when it comes to unreported income for my colleague as well as he would have to go through the gross negligence etc. But it just goes to show you how dangerous it could be if you have clients starting to post little bit too much information on line with regards to their personal lives or in particular their investments and their business which doesn’t matches with their income tax returns.

Obviously social media is a great platform to do marketing but make sure that the social media feed whatever channel that might be matches your tax filing because that was the case for my colleague’s client and it wasn’t very difficult for CRA to prove that the spouse was running the business as there were lot of proof available online with the pictures showcasing the spouse and her clients .

CRA is trying to update their tools, trying to use technology to their advantage and this is just another way that they can go out and try to find people that try to evade taxes or find ways to use it against the people that they are audting at the moment.

So something to be aware!!

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

June 6, 2018

There has been a long talk about the BitCoin – Is it for real? Is it going to stay for long? Is it going to replace the existing currencies? Is it stable?

Well for the purpose of this blog we are going to look at only one question and that is – What is the viewpoint of CRA ( Canada Revenue Agency) on BITCOIN and how is it aiming on taxing any income derived through this new era of currency exchange ? (in this blog Bitcoin means all kinds of Crypto Currencies available in the market)

For starters CRA has stated that “BitCoin will be treated as a Commodity/Security and will be taxable”. So what this statement means is BitCoin will be treated as any other investment you have in stocks/shares etc. If that is the case there could be following situations where a BitCoin can trigger a taxable transaction:

- Investment – If you have invested in BitCoin then you will be required to report the gain/loss on sale of the BitCoin as Capital Gain/Loss on Schedule 3 (only 50% of the profit is taxable). You would take the sale price and reduce it with the purchase price less any outlays/expenses for buying or selling the BitCoin.

- Trading – If you are doing Day Trading in BitCoin, meaning you are actively involved in buying and selling of BitCoin then it would be considered as business income and will be reported as such, hence 100% of the profits will be taxable.

- Mining – If you are mining and selling the BitCoin, it will be considered a business and 100% of the net profits are taxable.

- Accepting BitCoin as a mode of Payment – If you are selling your goods/services for an exchange with Bitcoin then it will have the same treatment as barter transactions, where FMV(fair market value) of product or service is reported as income. So in case of Bitcoin the fair market value of bitcoin will be considered for the purposes of reporting taxable income to CRA. FMV for BitCoin seems to be fairly easy to find as it is traded online.

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

June 5, 2018

By Court Order, PayPal is now required to provide CRA ( Canada Revenue Agency) with information on all the Canadian Business Accounts.

Here is a list of things you need to do if you have been accepting payments through PayPal :-

- Make sure that all the revenues are reported to the CRA in all your past, present and future tax returns. For the past returns if you want you can go ahead and make a voluntary disclosure by filing a T1Adj. We would suggest consulting with your CPA.

- As there could be lot of implications for unreported revenue, few of them are listed below:-

- If your revenue for PayPal was more than $30K then you would have to register for GST/HST and should have to collect, report and remit GST/HST to CRA. Consult your CPA for applicability on your business.

- In 2014, CRA introduced a Schedule 88 to be filed with your corporation return which essentially relates to disclosing your website and any online sales you generated through that website. If you have in the past failed to report on Schedule 88 then we would suggest filing it now because there can be a possibility of CRA audit.

Have a website but no online sales?– If your business has a website but does not sell products online and all services are provided through the office. If the website generates more business through marketing or online presence or may be from traffic on the website, in this case since products are not being sold online there isn’t a need to file the Schedule 88. But as CRA isn’t looking at this right now, and you never know when they will start, we would recommend it’s better to file the schedule even if it’s not necessarily a requirement.

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

June 1, 2018

The Canadian tax system is based on self-assessment, in that the government relies on you to report all your sources of income completely and accurately.

For Employees :-

- Institutions, employers and organizations are required to report income and other amounts paid to individuals and corporations on information slips (i.e. T- slips).

- These slips are filed with the government, therefore keep in mind that the CRA has information on your income before you even file your tax return.

- Once you have filed your return, the CRA does a “sweep” of the slips in its system. It compares the slips you have filed against what they have on file. If you miss a slip, they will re-assess you for it and send you the tax bill plus applicable interest.

- If you continue to “forget” to file slips or not report them, they could charge you penalties for unreported income. These are quite substantial on the second offence.

For Self Employed :-

- Even though your income may not be reported on a slip, you must still declare all of your income (i.e. foreign source pensions, dividends, interest, business income, professional income and income associated with your rental properties etc.)

- It is up to you to properly account for, and report them and if you fail to do so and CRA finds it that you have been evading taxes by not disclosing, there could be very harsh penalties.

- As these kinds of income doesn’t have a slip issued to CRA, it is up to the taxpayer to provide the information to declare this as income on the tax return.

Deductions and Tax Credits for All :-

Deductions and tax credits are up to you to report accurately. There are expenses and deductions that the CRA typically asks for documents upon review.

Common Questions Asked: –

- Do banks reports deposits to CRA?- The banks do not report deposits. When CRA does a full audit, they will ask to see bank statements for all family members in the household and ask for an explanation for deposits they cannot trace. CRA can’t check your bank accounts without informing you and there has to be a reason why they would do so (i.e. audit or special investigations typically). When someone is audited by CRA, they request all bank, credit card, and loan statements. In practice, we rely on the client and tell them it is their responsibility to report their income accurately.

- Should I report unearned income? – The best way to explain unearned income is to think of it as a deposit. For example, if you give me a $200 deposit to prepare your taxes, then I have not yet earned that $200 until I do the work and complete it. If you gave me that deposit on December 31 for example and I did not start the work, then at year end it would be classified as $100 of unearned income. I would not have to pay tax on this amount. If I complete your returns on January 15, then the $200 becomes income at that point and will be reported.

- Any penalties/interest if I have a refund and filed the tax return late? – As long as it is a refund, there should be no penalties and interest assessed. Late filing penalties are only assessed on balances owing. Interest may still be charged depending on the circumstances (if there were late or deficient installments, when the amounts due were actually paid, etc.)

- Should we file a return for 16 year old? – If there is income earned by the 16 year old, then I would file a return. If there is no income or tuition credits (which probably wouldn’t be the case for a 16 year old), then no need to file. In short, we usually file kids’ returns when they start making money or have income to declare.

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

March 22, 2018

It’s always a good idea to file a tax return when you turn 18 (and all future years for that matter) even though you do not have to from a technical standpoint. The reason behind that is, even though you have no income, but you can still be eligible for the GST/HST refundable credits (government will be sending you money if you are eligible) and it also “gets you on the books” with CRA.

We at Eccountant always advise people to file a return even if they don’t have to. Just file a nil return. It’s good to stay off the CRA radar.

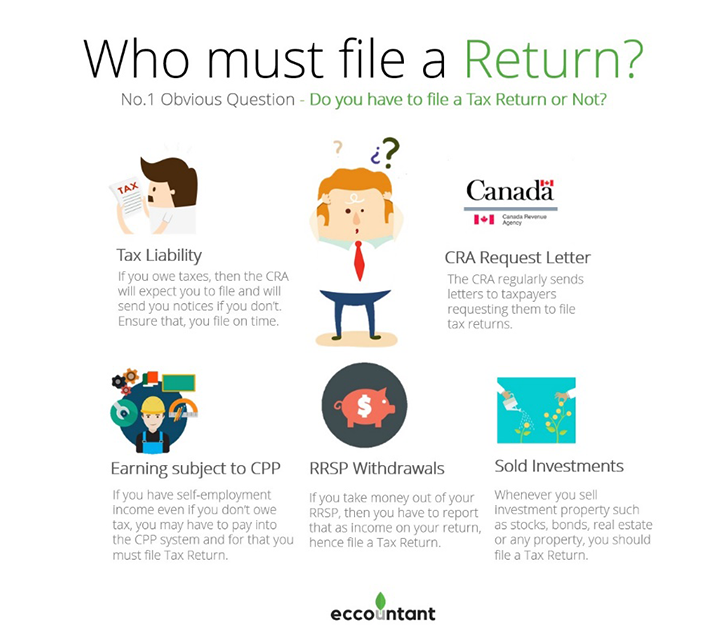

The following is a list of circumstances which require you to file a tax return

- If you have a tax liability you obviously must file

- If you have earnings that are subject to CPP contributions payable (i.e. self-employment income)

- You received a request from the CRA to file your tax return (even if you have no taxes or CPP owing)

- You withdrew amounts from an RRSP under the Home Buyers Plan or the Lifelong Learning Plan

- You sold investments or other capital property (i.e. stocks, real estate, other property)

Few Points to Note: –

- Loans are not income because they must be repaid therefore would not be considered taxable income and it does not have to be reported.

- The CPP refers to the Canada Pension Plan which is the pension system Canadians pay into during their working life. On an annual basis, those who are employed or self-employed make contributions and then when they retire (as early as age 60) they can begin drawing their pension income. QPP replaces the CPP for Quebec residents.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/you-have-file-a-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

March 22, 2018

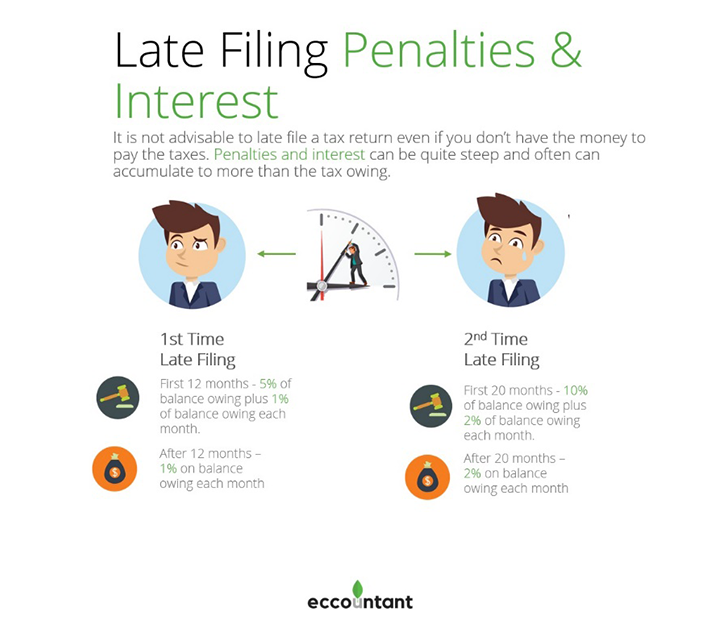

Late filing penalties:

Penalty of 5% of the balance owing plus 1% of the balance owing for each full month that the return is late to a maximum of 12 months.

If a tax return is filed late in any of the preceding taxation years, the penalty is increased to 10% of the balance owing, plus 2% of the balance owing for each full month the return is late, to a maximum of 20 months.

What if you have a valid reason for filing late?

Interest and penalties may be waived or cancelled by the CRA under certain circumstances under the Taxpayer Relief Provisions. The form RC4288, Request for Taxpayer Relief can be filled out and mailed to the CRA.

These requests must relate to any of the 10 calendar years before the year the request is made. Typically, the reasons for late filing must be beyond the control of the taxpayer such as natural or man-made disasters, civil disturbances or serious illness or accident.

Interest and penalties can also be forgiven if they resulted primarily from the actions of the CRA.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/interest-penalties.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook, LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

March 22, 2018

The Canadian tax system is based on self-assessment in that the government relies on you to report all your sources of income completely and accurately.

Institutions, employers and organizations are required to report income and other amounts paid to individuals and corporations on information slips (i.e. T-slips). These slips are filed with the government, therefore keep in mind that the CRA has information on your income before you even file your tax return.

Once you have filed your return, the CRA does a “sweep” of the slips in its system. It compares the slips you have filed against what they have on file. If you miss a slip, they will re-assess you for it and send you the tax bill plus applicable interest.

If you continue to “forget” to file slips or not report them, they could charge you penalties for unreported income. These are quite substantial on the second offence.

Even though income may not be reported on a slip, you must still declare all your income (i.e. foreign source pensions, dividends, interest, etc.). It is up to you to properly account for, and report business income, professional income and income associated with your rental properties.

Deductions and tax credits and deductions are up to you to report accurately. These are expenses and deductions that the CRA typically asks for documents upon review.

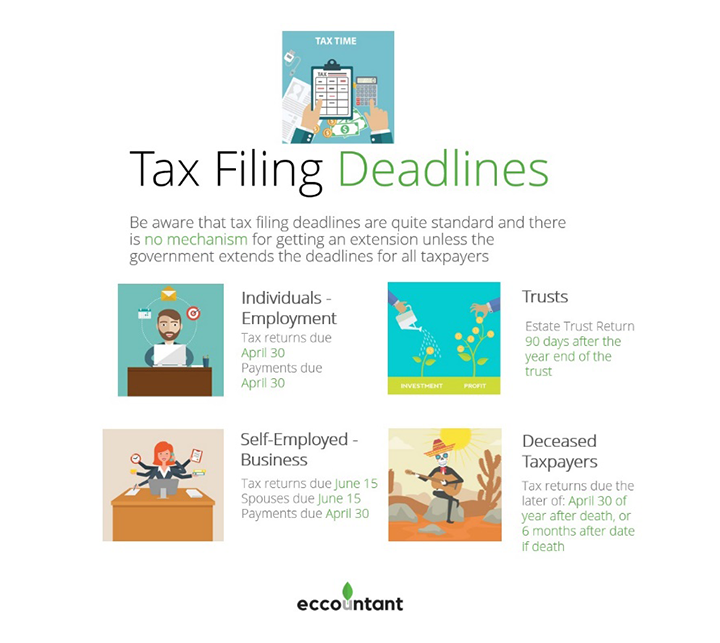

Due Date for T1 Returns:

Individuals

Tax returns and tax payments due April 30.

Individuals with self-employment income

Tax returns are due on June 15.

If tax is owing, payments should be made by April 30, otherwise CRA begins charging interest (but no penalties).

If your spouse is self-employed, your return is also due June 15 even though you may not have self-employment income. However, as above payments should be made by April 30 to avoid interest charges.

Tax returns for deceased individuals

Due the later of the following two dates:

- April 30 of the year after death (or June 15 if self-employed)

- Six (6) months after the date of death

What this means in practice is that if an individual dies November 1 or later, they will have some extra time to file their return. Dates of death prior to October 31 are due on April 30.

Trusts

Trust returns are due 90 days after the year end date of the trust (not 3 months, 90 days).

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/important-dates-individuals/filing-dates-2016-tax-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

March 22, 2018

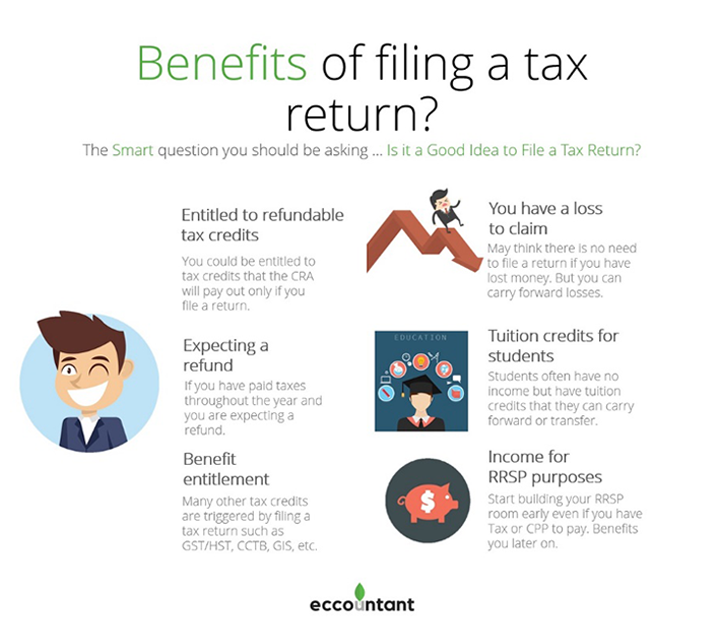

It’s always a good idea to file a tax return when you turn 18 (and all future years for that matter) even though you do not have to from a technical standpoint. The reason behind that is, even though you have no income, but you can still be eligible for the GST/HST refundable credits (government will be sending you money if you are eligible) and it also “gets you on the books” with CRA.

We at Eccountant always advise people to file a return even if they don’t have to. Just file a nil return. It’s good to stay off the CRA radar.

Following are some reasons why you should file a return and would be to your advantage/benefit:

- If you are expecting a refund (tax withheld from your sources)

- Refundable tax credits that you are entitled to, even if you don’t have taxable income

- To apply for the GST/HST credit (18 or older, quarterly payments)

- You want to apply for or be eligible for the Canada Child Benefit

- You have earned income for RRSP purposes even if you don’t want to contribute, or your income is below the threshold

- For seniors receiving the GIS, you must continue to file to continue to be eligible and receive the supplement

- If you sold securities or other property and have a capital loss, you can carry it back to previous years or carry it forward

- If you have tuition or education amounts that you want to carry forward to a year when you can use them

Few Points to Note: –

- The best way to make sure the student gets the credit is to file the income tax return in the year the tuition credit applies even if they have no income. The tuition credit would then carry forward automatically and can be applied in the year(s) they start earning income. You must file the tuition credit in the year it applies to and then carry it forward. You cannot claim the tuition in a different year. Always best to file the tax return on time in the year it applies.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/you-have-file-a-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.