March 22, 2018

The Canadian tax system is based on self-assessment in that the government relies on you to report all your sources of income completely and accurately.

Institutions, employers and organizations are required to report income and other amounts paid to individuals and corporations on information slips (i.e. T-slips). These slips are filed with the government, therefore keep in mind that the CRA has information on your income before you even file your tax return.

Once you have filed your return, the CRA does a “sweep” of the slips in its system. It compares the slips you have filed against what they have on file. If you miss a slip, they will re-assess you for it and send you the tax bill plus applicable interest.

If you continue to “forget” to file slips or not report them, they could charge you penalties for unreported income. These are quite substantial on the second offence.

Even though income may not be reported on a slip, you must still declare all your income (i.e. foreign source pensions, dividends, interest, etc.). It is up to you to properly account for, and report business income, professional income and income associated with your rental properties.

Deductions and tax credits and deductions are up to you to report accurately. These are expenses and deductions that the CRA typically asks for documents upon review.

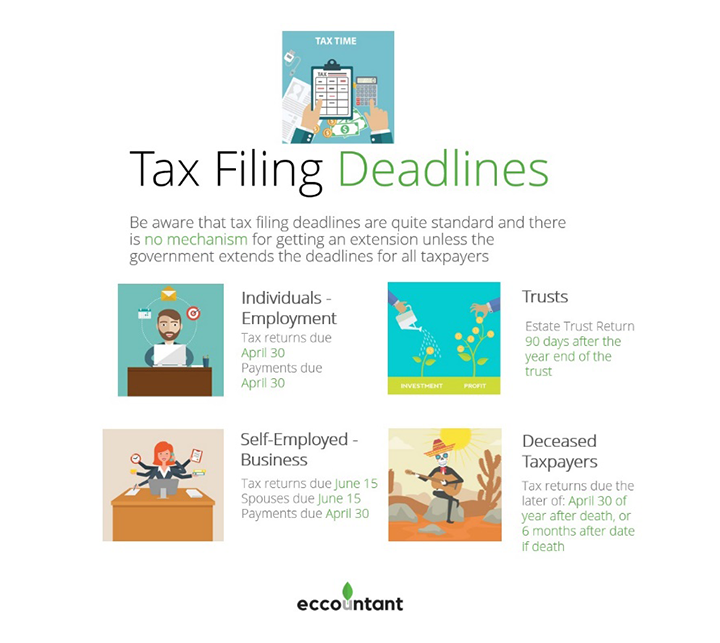

Due Date for T1 Returns:

Individuals

Tax returns and tax payments due April 30.

Individuals with self-employment income

Tax returns are due on June 15.

If tax is owing, payments should be made by April 30, otherwise CRA begins charging interest (but no penalties).

If your spouse is self-employed, your return is also due June 15 even though you may not have self-employment income. However, as above payments should be made by April 30 to avoid interest charges.

Tax returns for deceased individuals

Due the later of the following two dates:

- April 30 of the year after death (or June 15 if self-employed)

- Six (6) months after the date of death

What this means in practice is that if an individual dies November 1 or later, they will have some extra time to file their return. Dates of death prior to October 31 are due on April 30.

Trusts

Trust returns are due 90 days after the year end date of the trust (not 3 months, 90 days).

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/important-dates-individuals/filing-dates-2016-tax-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.