General

General

June 1, 2018

Self Assessment Canadian Tax System

The Canadian tax system is based on self-assessment, in that the government relies on you to report all your sources of income completely and accurately.

For Employees :-

- Institutions, employers and organizations are required to report income and other amounts paid to individuals and corporations on information slips (i.e. T- slips).

- These slips are filed with the government, therefore keep in mind that the CRA has information on your income before you even file your tax return.

- Once you have filed your return, the CRA does a “sweep” of the slips in its system. It compares the slips you have filed against what they have on file. If you miss a slip, they will re-assess you for it and send you the tax bill plus applicable interest.

- If you continue to “forget” to file slips or not report them, they could charge you penalties for unreported income. These are quite substantial on the second offence.

For Self Employed :-

- Even though your income may not be reported on a slip, you must still declare all of your income (i.e. foreign source pensions, dividends, interest, business income, professional income and income associated with your rental properties etc.)

- It is up to you to properly account for, and report them and if you fail to do so and CRA finds it that you have been evading taxes by not disclosing, there could be very harsh penalties.

- As these kinds of income doesn’t have a slip issued to CRA, it is up to the taxpayer to provide the information to declare this as income on the tax return.

Deductions and Tax Credits for All :-

Deductions and tax credits are up to you to report accurately. There are expenses and deductions that the CRA typically asks for documents upon review.

Common Questions Asked: –

- Do banks reports deposits to CRA?- The banks do not report deposits. When CRA does a full audit, they will ask to see bank statements for all family members in the household and ask for an explanation for deposits they cannot trace. CRA can’t check your bank accounts without informing you and there has to be a reason why they would do so (i.e. audit or special investigations typically). When someone is audited by CRA, they request all bank, credit card, and loan statements. In practice, we rely on the client and tell them it is their responsibility to report their income accurately.

- Should I report unearned income? – The best way to explain unearned income is to think of it as a deposit. For example, if you give me a $200 deposit to prepare your taxes, then I have not yet earned that $200 until I do the work and complete it. If you gave me that deposit on December 31 for example and I did not start the work, then at year end it would be classified as $100 of unearned income. I would not have to pay tax on this amount. If I complete your returns on January 15, then the $200 becomes income at that point and will be reported.

- Any penalties/interest if I have a refund and filed the tax return late? – As long as it is a refund, there should be no penalties and interest assessed. Late filing penalties are only assessed on balances owing. Interest may still be charged depending on the circumstances (if there were late or deficient installments, when the amounts due were actually paid, etc.)

- Should we file a return for 16 year old? – If there is income earned by the 16 year old, then I would file a return. If there is no income or tuition credits (which probably wouldn’t be the case for a 16 year old), then no need to file. In short, we usually file kids’ returns when they start making money or have income to declare.

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

General

General

March 22, 2018

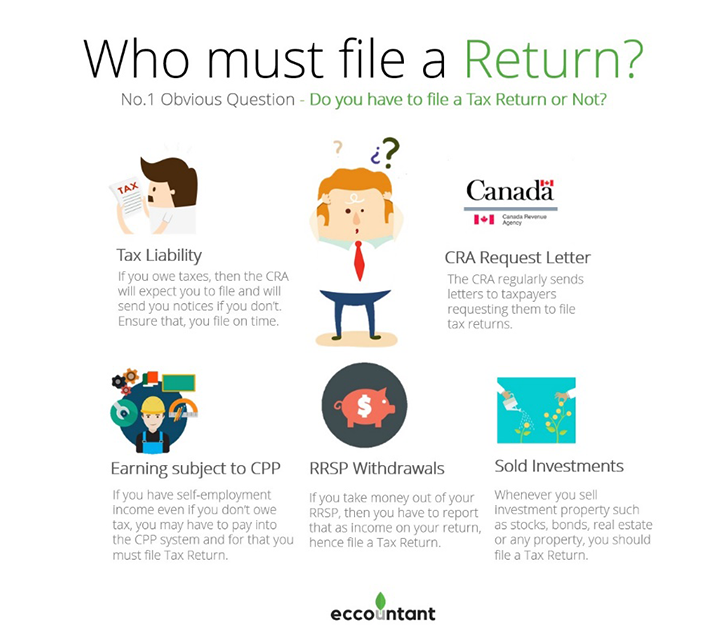

WHO MUST FILE A T1 RETURN

It’s always a good idea to file a tax return when you turn 18 (and all future years for that matter) even though you do not have to from a technical standpoint. The reason behind that is, even though you have no income, but you can still be eligible for the GST/HST refundable credits (government will be sending you money if you are eligible) and it also “gets you on the books” with CRA.

We at Eccountant always advise people to file a return even if they don’t have to. Just file a nil return. It’s good to stay off the CRA radar.

The following is a list of circumstances which require you to file a tax return

- If you have a tax liability you obviously must file

- If you have earnings that are subject to CPP contributions payable (i.e. self-employment income)

- You received a request from the CRA to file your tax return (even if you have no taxes or CPP owing)

- You withdrew amounts from an RRSP under the Home Buyers Plan or the Lifelong Learning Plan

- You sold investments or other capital property (i.e. stocks, real estate, other property)

Few Points to Note: –

- Loans are not income because they must be repaid therefore would not be considered taxable income and it does not have to be reported.

- The CPP refers to the Canada Pension Plan which is the pension system Canadians pay into during their working life. On an annual basis, those who are employed or self-employed make contributions and then when they retire (as early as age 60) they can begin drawing their pension income. QPP replaces the CPP for Quebec residents.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/you-have-file-a-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

General

General

March 22, 2018

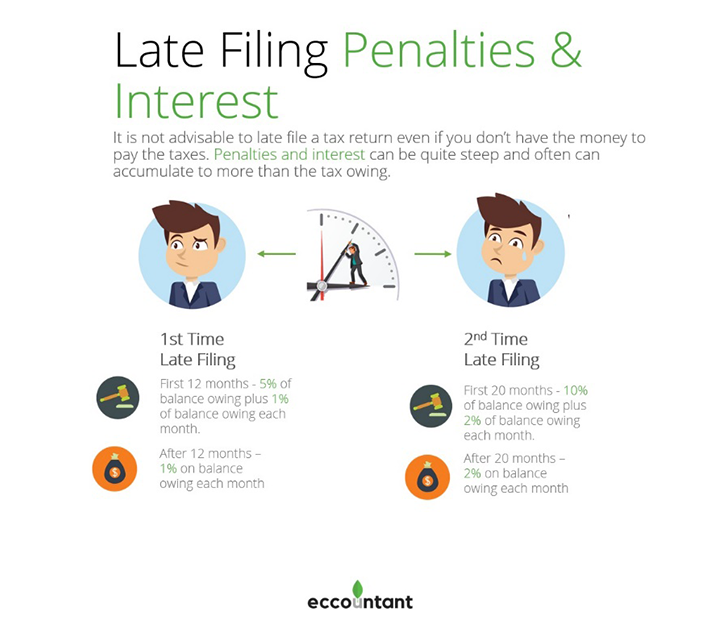

T1 LATE FILING PENALTIES

Late filing penalties:

Penalty of 5% of the balance owing plus 1% of the balance owing for each full month that the return is late to a maximum of 12 months.

If a tax return is filed late in any of the preceding taxation years, the penalty is increased to 10% of the balance owing, plus 2% of the balance owing for each full month the return is late, to a maximum of 20 months.

What if you have a valid reason for filing late?

Interest and penalties may be waived or cancelled by the CRA under certain circumstances under the Taxpayer Relief Provisions. The form RC4288, Request for Taxpayer Relief can be filled out and mailed to the CRA.

These requests must relate to any of the 10 calendar years before the year the request is made. Typically, the reasons for late filing must be beyond the control of the taxpayer such as natural or man-made disasters, civil disturbances or serious illness or accident.

Interest and penalties can also be forgiven if they resulted primarily from the actions of the CRA.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/interest-penalties.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook, LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

General

General

March 22, 2018

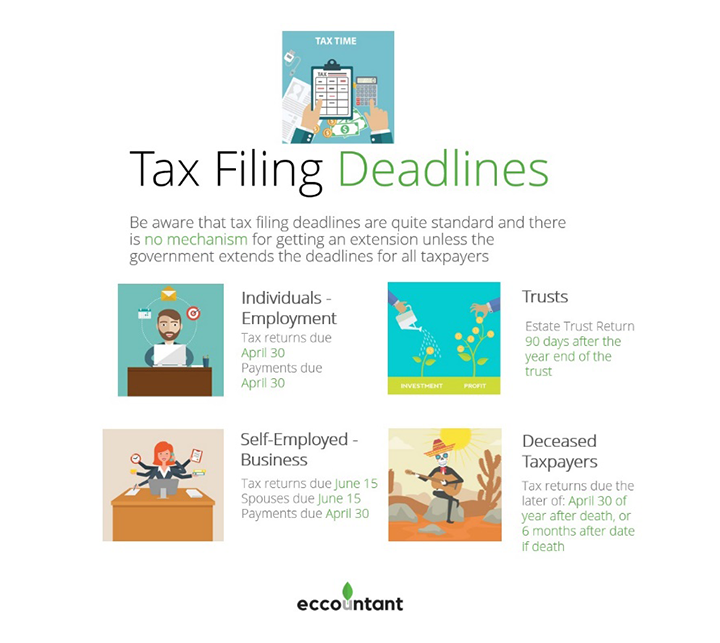

T1 RETURN DEADLINES

The Canadian tax system is based on self-assessment in that the government relies on you to report all your sources of income completely and accurately.

Institutions, employers and organizations are required to report income and other amounts paid to individuals and corporations on information slips (i.e. T-slips). These slips are filed with the government, therefore keep in mind that the CRA has information on your income before you even file your tax return.

Once you have filed your return, the CRA does a “sweep” of the slips in its system. It compares the slips you have filed against what they have on file. If you miss a slip, they will re-assess you for it and send you the tax bill plus applicable interest.

If you continue to “forget” to file slips or not report them, they could charge you penalties for unreported income. These are quite substantial on the second offence.

Even though income may not be reported on a slip, you must still declare all your income (i.e. foreign source pensions, dividends, interest, etc.). It is up to you to properly account for, and report business income, professional income and income associated with your rental properties.

Deductions and tax credits and deductions are up to you to report accurately. These are expenses and deductions that the CRA typically asks for documents upon review.

Due Date for T1 Returns:

Individuals

Tax returns and tax payments due April 30.

Individuals with self-employment income

Tax returns are due on June 15.

If tax is owing, payments should be made by April 30, otherwise CRA begins charging interest (but no penalties).

If your spouse is self-employed, your return is also due June 15 even though you may not have self-employment income. However, as above payments should be made by April 30 to avoid interest charges.

Tax returns for deceased individuals

Due the later of the following two dates:

- April 30 of the year after death (or June 15 if self-employed)

- Six (6) months after the date of death

What this means in practice is that if an individual dies November 1 or later, they will have some extra time to file their return. Dates of death prior to October 31 are due on April 30.

Trusts

Trust returns are due 90 days after the year end date of the trust (not 3 months, 90 days).

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/important-dates-individuals/filing-dates-2016-tax-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.

General

General

March 22, 2018

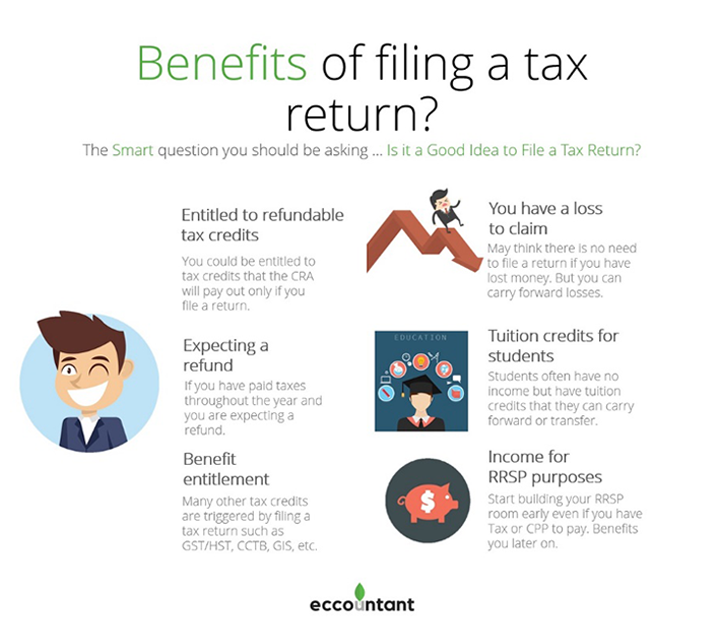

BENEFITS OF FILING A T1 RETURN

It’s always a good idea to file a tax return when you turn 18 (and all future years for that matter) even though you do not have to from a technical standpoint. The reason behind that is, even though you have no income, but you can still be eligible for the GST/HST refundable credits (government will be sending you money if you are eligible) and it also “gets you on the books” with CRA.

We at Eccountant always advise people to file a return even if they don’t have to. Just file a nil return. It’s good to stay off the CRA radar.

Following are some reasons why you should file a return and would be to your advantage/benefit:

- If you are expecting a refund (tax withheld from your sources)

- Refundable tax credits that you are entitled to, even if you don’t have taxable income

- To apply for the GST/HST credit (18 or older, quarterly payments)

- You want to apply for or be eligible for the Canada Child Benefit

- You have earned income for RRSP purposes even if you don’t want to contribute, or your income is below the threshold

- For seniors receiving the GIS, you must continue to file to continue to be eligible and receive the supplement

- If you sold securities or other property and have a capital loss, you can carry it back to previous years or carry it forward

- If you have tuition or education amounts that you want to carry forward to a year when you can use them

Few Points to Note: –

- The best way to make sure the student gets the credit is to file the income tax return in the year the tuition credit applies even if they have no income. The tuition credit would then carry forward automatically and can be applied in the year(s) they start earning income. You must file the tuition credit in the year it applies to and then carry it forward. You cannot claim the tuition in a different year. Always best to file the tax return on time in the year it applies.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/you-have-file-a-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.