March 22, 2018

It’s always a good idea to file a tax return when you turn 18 (and all future years for that matter) even though you do not have to from a technical standpoint. The reason behind that is, even though you have no income, but you can still be eligible for the GST/HST refundable credits (government will be sending you money if you are eligible) and it also “gets you on the books” with CRA.

We at Eccountant always advise people to file a return even if they don’t have to. Just file a nil return. It’s good to stay off the CRA radar.

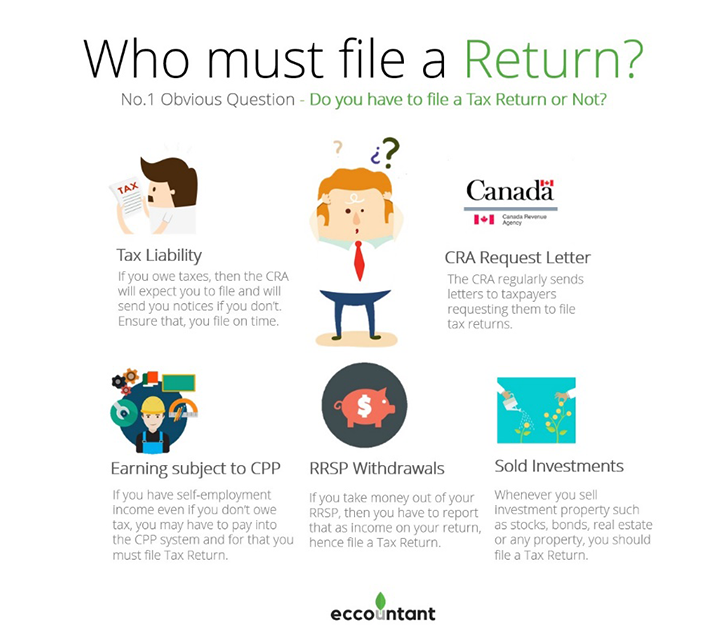

The following is a list of circumstances which require you to file a tax return

- If you have a tax liability you obviously must file

- If you have earnings that are subject to CPP contributions payable (i.e. self-employment income)

- You received a request from the CRA to file your tax return (even if you have no taxes or CPP owing)

- You withdrew amounts from an RRSP under the Home Buyers Plan or the Lifelong Learning Plan

- You sold investments or other capital property (i.e. stocks, real estate, other property)

Few Points to Note: –

- Loans are not income because they must be repaid therefore would not be considered taxable income and it does not have to be reported.

- The CPP refers to the Canada Pension Plan which is the pension system Canadians pay into during their working life. On an annual basis, those who are employed or self-employed make contributions and then when they retire (as early as age 60) they can begin drawing their pension income. QPP replaces the CPP for Quebec residents.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/you-have-file-a-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.