March 22, 2018

Late filing penalties:

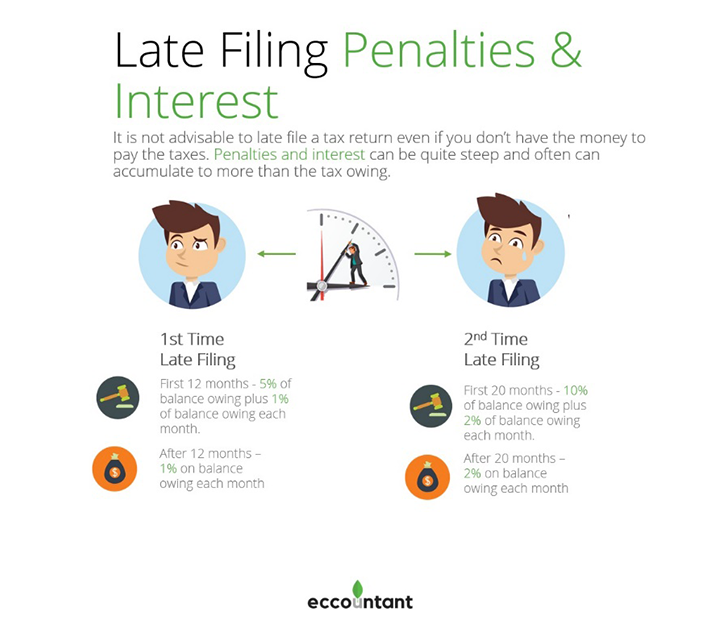

Penalty of 5% of the balance owing plus 1% of the balance owing for each full month that the return is late to a maximum of 12 months.

If a tax return is filed late in any of the preceding taxation years, the penalty is increased to 10% of the balance owing, plus 2% of the balance owing for each full month the return is late, to a maximum of 20 months.

What if you have a valid reason for filing late?

Interest and penalties may be waived or cancelled by the CRA under certain circumstances under the Taxpayer Relief Provisions. The form RC4288, Request for Taxpayer Relief can be filled out and mailed to the CRA.

These requests must relate to any of the 10 calendar years before the year the request is made. Typically, the reasons for late filing must be beyond the control of the taxpayer such as natural or man-made disasters, civil disturbances or serious illness or accident.

Interest and penalties can also be forgiven if they resulted primarily from the actions of the CRA.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/interest-penalties.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook, LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.