March 22, 2018

It’s always a good idea to file a tax return when you turn 18 (and all future years for that matter) even though you do not have to from a technical standpoint. The reason behind that is, even though you have no income, but you can still be eligible for the GST/HST refundable credits (government will be sending you money if you are eligible) and it also “gets you on the books” with CRA.

We at Eccountant always advise people to file a return even if they don’t have to. Just file a nil return. It’s good to stay off the CRA radar.

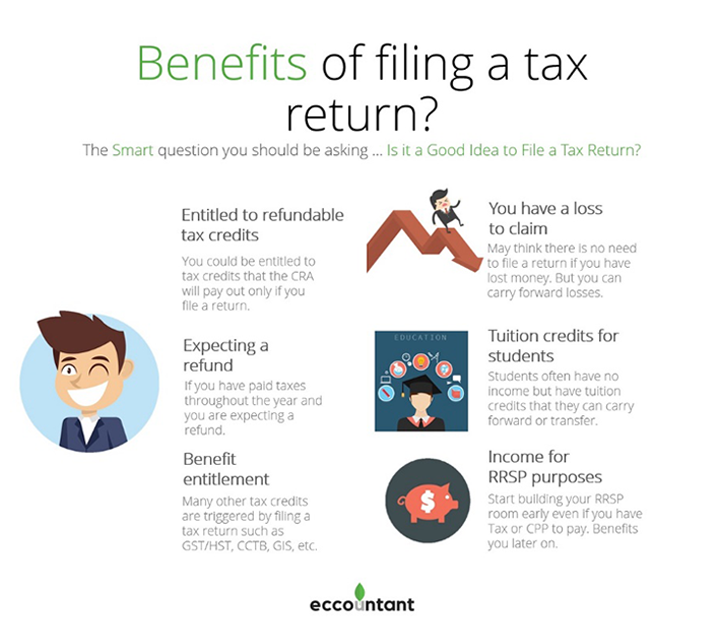

Following are some reasons why you should file a return and would be to your advantage/benefit:

- If you are expecting a refund (tax withheld from your sources)

- Refundable tax credits that you are entitled to, even if you don’t have taxable income

- To apply for the GST/HST credit (18 or older, quarterly payments)

- You want to apply for or be eligible for the Canada Child Benefit

- You have earned income for RRSP purposes even if you don’t want to contribute, or your income is below the threshold

- For seniors receiving the GIS, you must continue to file to continue to be eligible and receive the supplement

- If you sold securities or other property and have a capital loss, you can carry it back to previous years or carry it forward

- If you have tuition or education amounts that you want to carry forward to a year when you can use them

Few Points to Note: –

- The best way to make sure the student gets the credit is to file the income tax return in the year the tuition credit applies even if they have no income. The tuition credit would then carry forward automatically and can be applied in the year(s) they start earning income. You must file the tuition credit in the year it applies to and then carry it forward. You cannot claim the tuition in a different year. Always best to file the tax return on time in the year it applies.

You can find more information related to this on the CRA website, please find below the link to it: –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/you-have-file-a-return.html

In case you have any comments or questions please feel free to leave them in the comments sections below or you can send us an email at info@eccountant.ca or chat with us online at our website or you can send us messages at our Facebook , LinkedIn or Twitter Pages, the link to all of them is in our home page. You can also chat with us at our WhatsApp no. 905-581-5412.