July 29, 2024

Is Business Meal Deductible ?

What Counts as a Business Meal? Under the Canadian Income Tax Act, a business meal can be deducted from your taxes if it meets these criteria: Purpose: The meal must be for a business reason. Think meetings with clients, potential customers, consultants, or employees where you discuss business stuff like activities, strategies, or projects. Setting: The meal should happen in a place good for business talks, not your usual work spot. This could be during business travel, at a restaurant, or even a catered meeting. Documentation: Keep good records! You need receipts that show the expense, who was there, their relationship to you, and why you had the meal. Reasonableness: The cost should be reasonable, not over-the-top fancy. What Doesn't Count as a Business Meal? Personal Meals: These are meals you eat just because you're hungry, not for business. Regular work-hour meals without business discussions or meals alone don't count....

June 20, 2018

Vehical Expenses 101 : Deducting Vehicle Expenses from Income

Every client has asked me this - Can i claim expenses incurred on my Car against my income? Can I reduce my taxes by doing so? What do I need to do to claim Car/Vehicle Expenses? Well I am going to answer all these questions and more in this blog I would like to summarize the whole Vehicle Expense answer into this statement : You can write off your vehicle expenses if used the vehicle for business and if you did, you need to keep track of all vehicle expenses and also keep the relevant receipts. What Can I deduct in Car expenses ? Gas and oil Repairs and maintenance Insurance Lease costs or depreciation License fees What is Business Use ? Travelling from office to a client is considered business and vice versa. You can only write off the proportion of expenses used for business purposes. Personal travel is not deductible. To do...

June 11, 2018

CRA using Social Media for Audits

CRA using Social Media to its Advantage? Well over the last few months we have come across this - a lot - CRA could be using social media to determine if people are reporting their income correctly or not and they could be using it as a tool during their audit process. So the way this came to light was a few months back, CRA started targeting people from LinkedIn, who were bragging about their return on investment from their TFSA investments. There were people on LinkedIn that were stating that they were making $ 100K or more and it basically triggered the CRA to look at these people and see whether or not they were following the rules that they needed to in relation to TFSA accounts and that's how it all started. Now in my own personal experience I was actually discussing this with my colleague and she...

June 6, 2018

CRA’s Take on BITCOIN

There has been a long talk about the BitCoin - Is it for real? Is it going to stay for long? Is it going to replace the existing currencies? Is it stable? Well for the purpose of this blog we are going to look at only one question and that is - What is the viewpoint of CRA ( Canada Revenue Agency) on BITCOIN and how is it aiming on taxing any income derived through this new era of currency exchange ? (in this blog Bitcoin means all kinds of Crypto Currencies available in the market) For starters CRA has stated that "BitCoin will be treated as a Commodity/Security and will be taxable". So what this statement means is BitCoin will be treated as any other investment you have in stocks/shares etc. If that is the case there could be following situations where a BitCoin can trigger a taxable transaction: Investment - If you have...

June 5, 2018

PayPal discloses information to CRA : Court Order : Things to Do!

By Court Order, PayPal is now required to provide CRA ( Canada Revenue Agency) with information on all the Canadian Business Accounts. Here is a list of things you need to do if you have been accepting payments through PayPal :- Make sure that all the revenues are reported to the CRA in all your past, present and future tax returns. For the past returns if you want you can go ahead and make a voluntary disclosure by filing a T1Adj. We would suggest consulting with your CPA. As there could be lot of implications for unreported revenue, few of them are listed below:- If your revenue for PayPal was more than $30K then you would have to register for GST/HST and should have to collect, report and remit GST/HST to CRA. Consult your CPA for applicability on your business. In 2014, CRA introduced a Schedule 88 to be filed...

June 1, 2018

Self Assessment Canadian Tax System

The Canadian tax system is based on self-assessment, in that the government relies on you to report all your sources of income completely and accurately. For Employees :- Institutions, employers and organizations are required to report income and other amounts paid to individuals and corporations on information slips (i.e. T- slips). These slips are filed with the government, therefore keep in mind that the CRA has information on your income before you even file your tax return. Once you have filed your return, the CRA does a “sweep” of the slips in its system. It compares the slips you have filed against what they have on file. If you miss a slip, they will re-assess you for it and send you the tax bill plus applicable interest. If you continue to “forget” to file slips or not report them, they could charge you penalties for unreported income. These are quite...

March 22, 2018

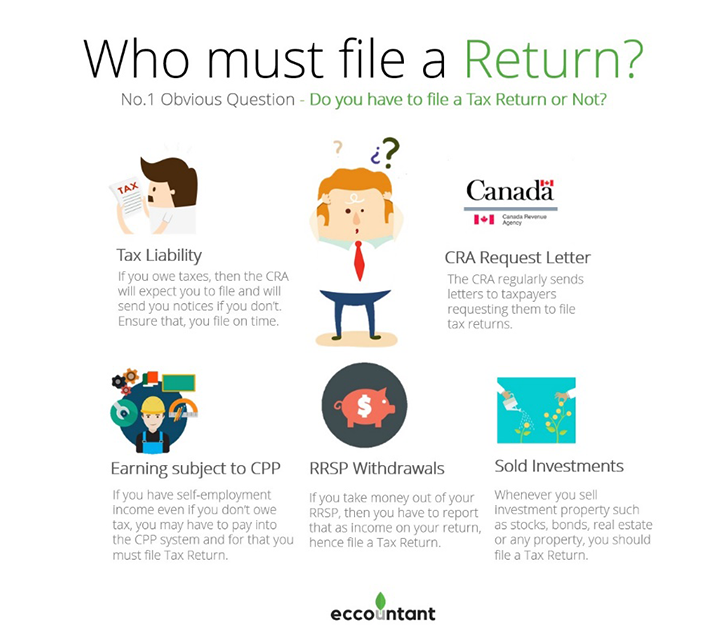

WHO MUST FILE A T1 RETURN

It's always a good idea to file a tax return when you turn 18 (and all future years for that matter) even though you do not have to from a technical standpoint. The reason behind that is, even though you have no income, but you can still be eligible for the GST/HST refundable credits (government will be sending you money if you are eligible) and it also "gets you on the books" with CRA. We at Eccountant always advise people to file a return even if they don't have to. Just file a nil return. It's good to stay off the CRA radar. The following is a list of circumstances which require you to file a tax return If you have a tax liability you obviously must file If you have earnings that are subject to CPP contributions payable (i.e. self-employment income) You received a request from the CRA to...

March 22, 2018

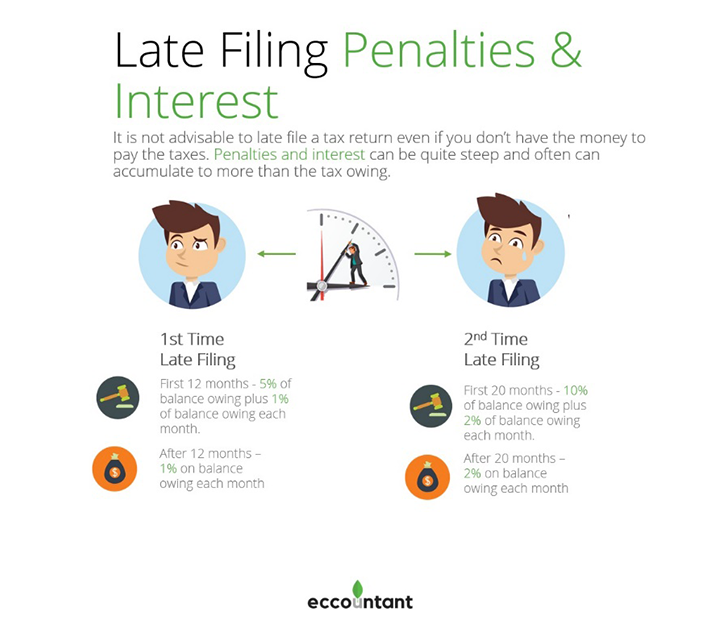

T1 LATE FILING PENALTIES

Late filing penalties: Penalty of 5% of the balance owing plus 1% of the balance owing for each full month that the return is late to a maximum of 12 months. If a tax return is filed late in any of the preceding taxation years, the penalty is increased to 10% of the balance owing, plus 2% of the balance owing for each full month the return is late, to a maximum of 20 months. What if you have a valid reason for filing late? Interest and penalties may be waived or cancelled by the CRA under certain circumstances under the Taxpayer Relief Provisions. The form RC4288, Request for Taxpayer Relief can be filled out and mailed to the CRA. These requests must relate to any of the 10 calendar years before the year the request is made. Typically, the reasons for late filing must be beyond the control of...

March 22, 2018

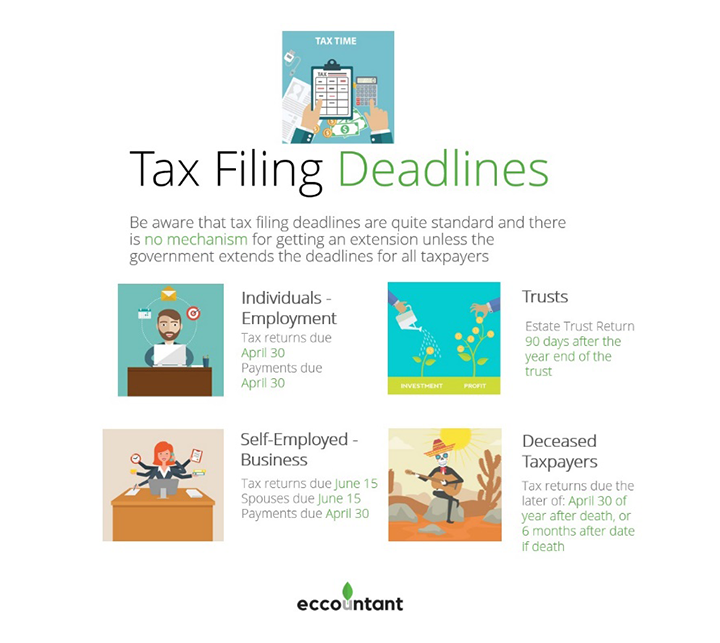

T1 RETURN DEADLINES

The Canadian tax system is based on self-assessment in that the government relies on you to report all your sources of income completely and accurately. Institutions, employers and organizations are required to report income and other amounts paid to individuals and corporations on information slips (i.e. T-slips). These slips are filed with the government, therefore keep in mind that the CRA has information on your income before you even file your tax return. Once you have filed your return, the CRA does a “sweep” of the slips in its system. It compares the slips you have filed against what they have on file. If you miss a slip, they will re-assess you for it and send you the tax bill plus applicable interest. If you continue to “forget” to file slips or not report them, they could charge you penalties for unreported income. These are quite substantial on the second...

March 22, 2018

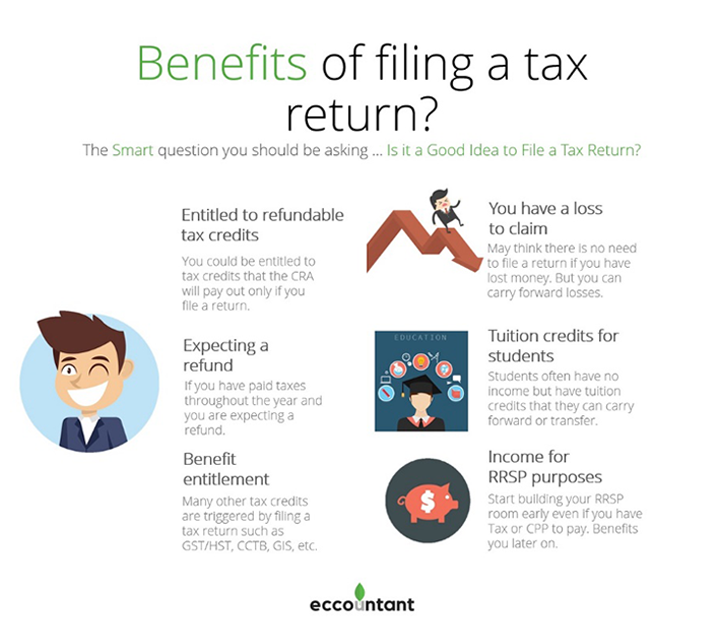

BENEFITS OF FILING A T1 RETURN

It's always a good idea to file a tax return when you turn 18 (and all future years for that matter) even though you do not have to from a technical standpoint. The reason behind that is, even though you have no income, but you can still be eligible for the GST/HST refundable credits (government will be sending you money if you are eligible) and it also "gets you on the books" with CRA. We at Eccountant always advise people to file a return even if they don't have to. Just file a nil return. It's good to stay off the CRA radar. Following are some reasons why you should file a return and would be to your advantage/benefit: If you are expecting a refund (tax withheld from your sources) Refundable tax credits that you are entitled to, even if you don’t have taxable income To apply for the GST/HST...